While global financial markets chalked up 9% gains over the first six months of the year, a number of investors are spotlighting the high valuations of stocks along with the intrinsically increased risk of their portfolios. On top of this, some uncertainties, which include the trouble in predicting the budgetary and regulatory policies of the Trump administration, could weigh on the markets in the near future. With this in mind, being able to anticipate and manage bearish trends on the equity markets regardless of their timing and magnitude could prove to be key and ultimately improve the risk/return profile of a global portfolio.

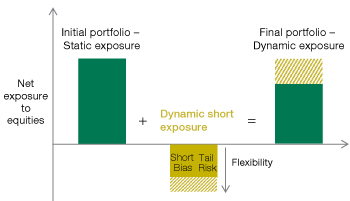

It is possible to offer investors a low-cost and active investment solution aiming at increasing the protection of their equity pocket in the event of a market downturn. This is based on a combination of two strategies that specifically respond to two types of risk. The first of these is a core Short Bias strategy, which seeks protection against standard market corrections of less than 10% through short and long future and option positions among plain-vanilla, highly liquid and listed indices such as the S&P 500 and the Euro Stoxx 50.

The second is a satellite strategy called Tail Risk, which aims to protect investors against less frequent but more extreme market corrections, i.e. those in the order of 10% or more, through long exposure to volatility futures such as the VIX and the VStoxx. This strategy seeks to take advantage of the positive correlation between the magnitude of a market correction and the volatility peak associated with it, hence the need for long exposure to volatility futures.

A dynamic short exposure solution suits every type of investor, as it fits into a risk management approach. In addition to this, it remains flexible, depending on the level of protection sought, whether this is low or high.

Figure 1: Dynamic short exposure enables dynamic adjustment of the net exposure of an equity portfolio

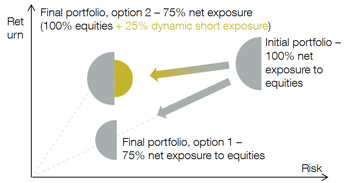

It goes without saying that a dynamic short exposure solution must also demonstrate its added value in terms of performance, as it seeks out positive alpha over static benchmark indexes. Figure 2 shows the idea of risk reduction against return. So, starting with the same initial portfolio, risk reduction implemented by adding a dynamically managed short exposure (option 2) will target an improvement in the portfolio’s risk/return profile, unlike one which simply reduces its equity exposure (option 1), all things being equal in terms of final exposure level (in this example, 75%).

Figure 2: Dynamic short exposure enables an equity portfolio’s risk/return profile to be improved

Olivier Marion

Senior Investment Specialist – Alternatives