新闻中心/瑞联卓见

-

-

08.11.2023

UBP doubles down on RMs to capture Southeast Asia wealth boom

Asian Private Banker, Audrey Raj (02.11.2023) - Since Eric Morin took over as head of Southeast Asia, UBP has significantly expanded its team of relationship managers, rapidly increasing its headcount for Southeast Asia as part of its ambitious strategy to capitalise on wealth opportunities in key markets like Singapore, Indonesia, Malaysia, and Thailand.

-

08.11.2023

Global equities: time in the market rather than timing the market

With a rebound in EPS growth expected for 2024, though with disparities between market segments, and with interest rates and inflation still at elevated levels, active management is key.

-

07.11.2023

Impact investing: managing short-term expectations

Le Temps (06.11.2023) - In the last two years, returns from impact strategies have been fairly disappointing, particularly compared with investments focusing on major tech stocks.

-

03.11.2023

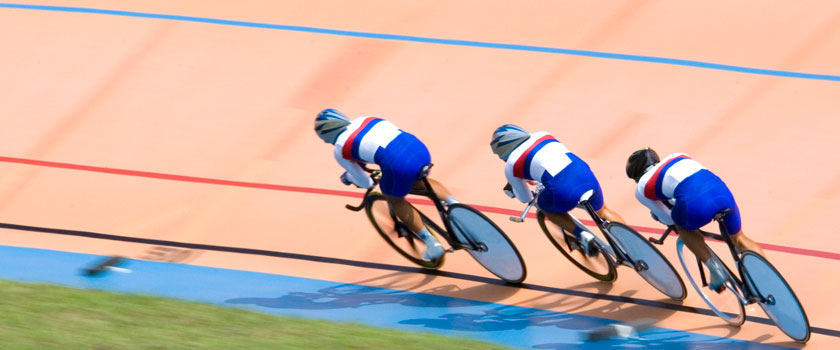

Third UBP Next Gen Academy a success

The UBP Next Generation Academy – which recently took place again, four years after the previous edition, partly in Paris and partly in Geneva – brought together an eclectic and multicultural group of young people with a lot to share and a keen interest in learning from the course and from each other.

-

30.10.2023

Building an efficient equity portfolio of global leaders today

Research has shown that 30 stocks is enough for a portfolio to efficiently diversify risks – and this without even taking into account the added benefits of active stock selection.

-

24.10.2023

“Let’s Discuss Nature with Climate: Engagement Guide” published

In October, the Cambridge Institute of Sustainability Leadership (CISL) published a landmark report, “Let’s Discuss Nature with Climate: Engagement Guide”, which gives detailed guidance to banks and investment managers about how to bring nature into their engagement with clients and investee companies.

-

18.10.2023

UBP bolsters its emerging market fixed income capabilities

Union Bancaire Privée, UBP SA (UBP) announced today that it has further strengthened its emerging market (EM) fixed income capabilities by hiring three seasoned experts and developing its EM fixed income product range into a comprehensive offering embedding responsible investment principles.

-

17.10.2023

Dollarisation could be good for Argentina

Allnews, Emmanuel Garessus (09.10.2023) - UBP strategist Alonso Perez-Kakabadse took part in Ecuador’s dollarisation process. He assesses the situation in Argentina.

-

13.10.2023

Assessing positive impact in pharmaceuticals

Pharma is a complex and fast-changing industry that plays a vital role in improving health outcomes and global access to medicines.

-

10.10.2023

Building Bridges 2023: Momentum grows for sustainable finance transition

From 2-5 October, Building Bridges, co-hosted by Sustainable Finance Geneva (SFG) and Swiss Sustainable Finance (SSF), attracted a record-breaking 2600 participants from banks, insurance companies, big corporations, governments, international organisations, NGOs and academia for more than 70 plenaries, discussions, and workshops.

-

05.10.2023

Investment Update panel addresses Asia clients and prospects

Sharing insights is an important way for us to engage and connect with our clients. In September 2023, we held a series of dinners in Asia, including in Hong Kong and Singapore, in which we looked back at our mid-year "Walking the tightrope" analysis and expectations.

Our latest podcasts

-

UBP Family Office Solutions: Guidance from the heart

Speakers: Monica Espinosa, Pierre Ricq

-

UBP's strategic income strategy: a smarter way to invest

Speakers: Mohammed Kazmi, Alisdair Bell