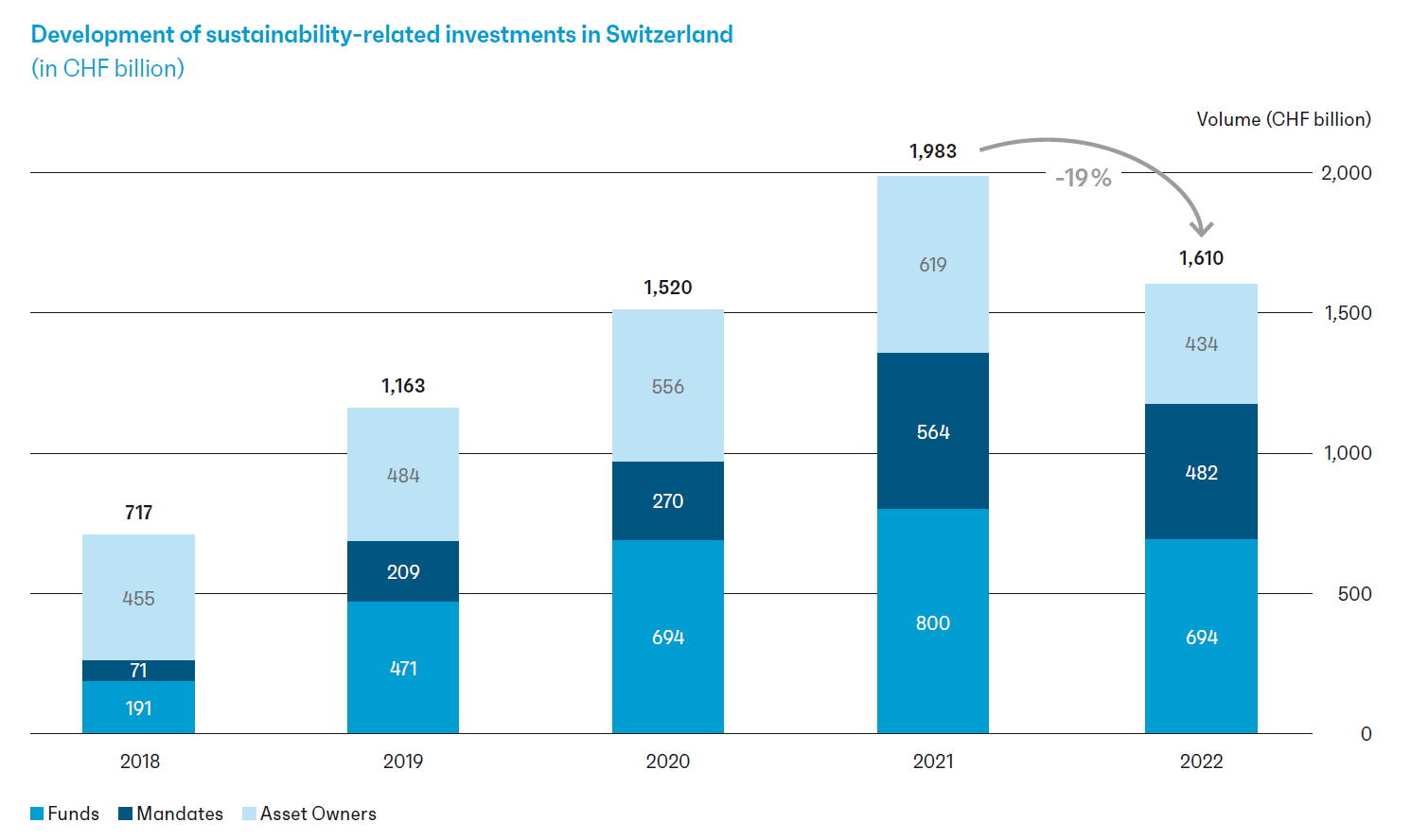

After years of growth, the total volume of sustainability-related investments in Switzerland declined in 2022, although thematic and impact investing saw remarkable growth.

According to the Swiss Sustainable Finance (SSF) Market Study 2023, sustainability-related investments dropped 19% to CHF 1.61 trillion by the end of 2022 compared to 2021. This decrease can be attributed to a generally negative market performance, which declined 18% in 2022, and tighter definitions of what can be considered “sustainable.”

Together with over 80 financial market players, UBP responded to the annual survey which served as the basis for the report.

Increasing regulations

In an effort to promote Switzerland as a leader in sustainable finance, regulatory activities by the Parliament, Federal Council and FINMA have intensified alongside soft law developments on the part of finance organisations/associations. However, the Swiss sustainable finance regulatory landscape remains fragmented.

The evolving regulatory landscape in the EU, where sustainable finance regulation is a key element in the effort to build a green economy, is adding to the complexity. Companies and financial institutions are grappling with challenging disclosure and reporting requirements under the EU Taxonomy, SFDR, and CSRD.

However, importantly, these regulations have sent a strong signal to the market to address the topic of sustainability and have set in motion continuous transparency improvements.

Upward trend in impact and thematic investments

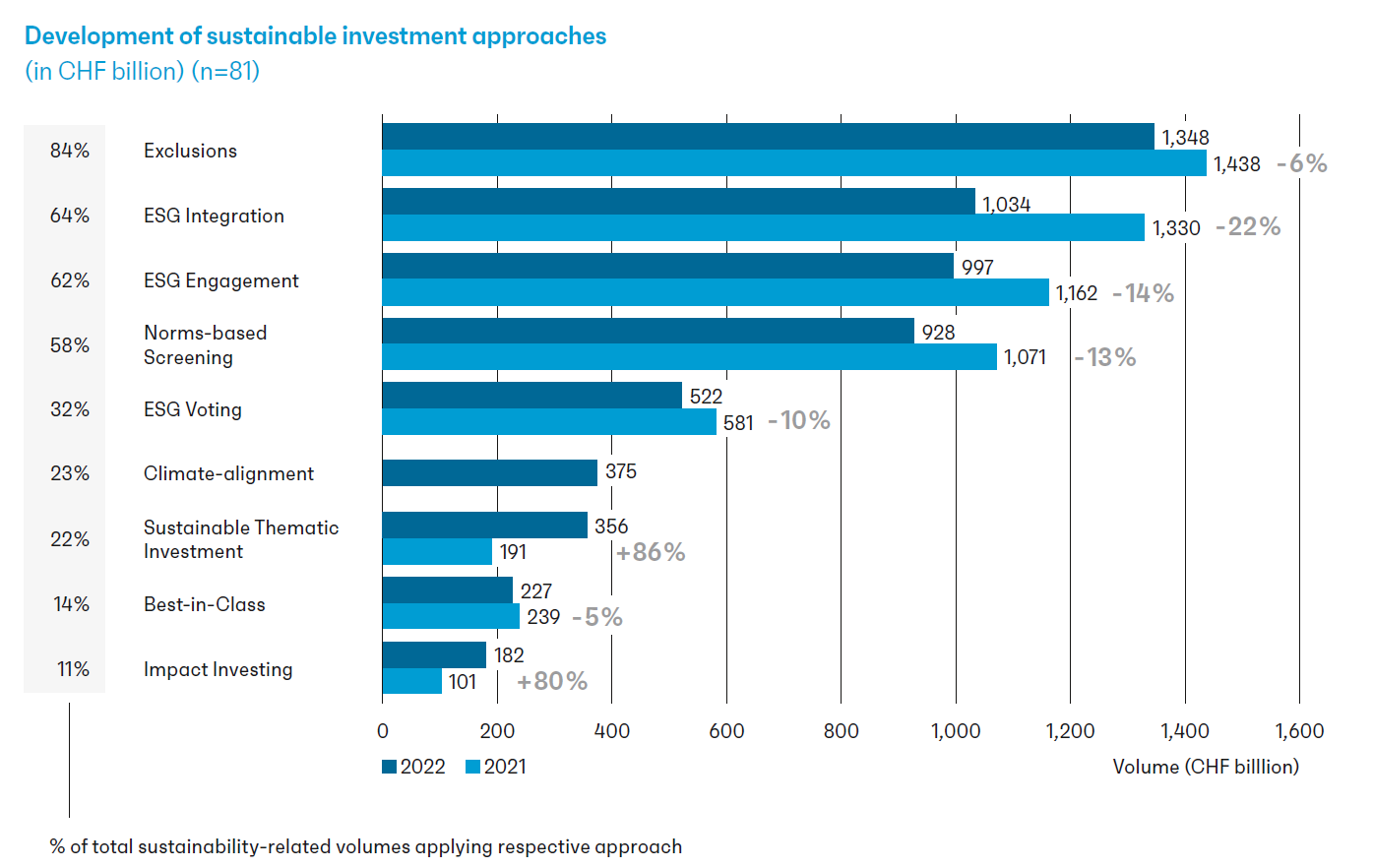

Despite the overall decline in sustainability-related investments, impact investing and thematic investments saw remarkable growth. Impact investments rose 80% while thematic investments increased by 86%, demonstrating investors’ appetite for impacted-related approaches.

For the first time, the study reported on the climate-alignment approach, which focuses on reducing the carbon footprint of a portfolio or its components. With CHF 375 billion, or about 20% of total sustainability-related assets, this approach is already well-established in the Swiss market.

“The sharp increase in thematic and impact investing reflects a shift away from negative screening and basic ESG integration to business model alignment with sustainability challenges. The sector still needs to gain in maturity, supported by more coordinated regulatory frameworks, to efficiently channel capital towards sustainable activities. Switzerland should seize the opportunity to remain at the forefront of this industry transformation.”

Nicolas Barben, Global Head of ESG Solutions

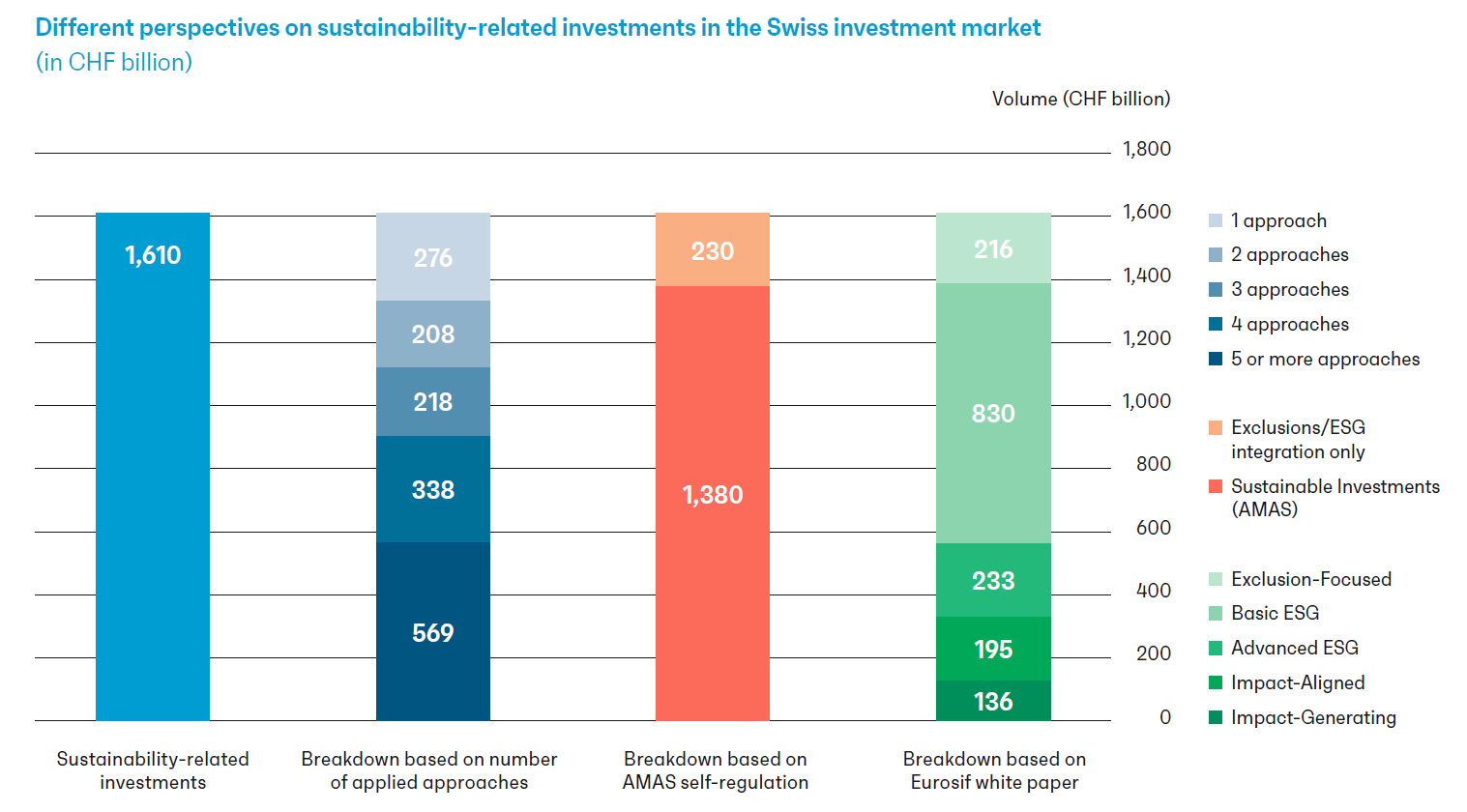

Rise of differing perspectives

In the absence of a clear definition of “sustainable investments”, this year, the report focuses on providing details of different approaches to integrating sustainability into investments and, on the basis of this, reports the total of sustainability-related investments. The three applied lenses show how different the perspectives in classifying sustainability-related investments can be, depending on which methodology is applied, ranging from simple to complex.

Zooming in on sustainable finance topics

Beyond the quantitative trends, the report provides insights into four developing themes: real estate, sustainability-related debt investments, climate change and biodiversity.

The report also features several case studies from its sponsors, including one on “Investment opportunities in transition infrastructure” by UBP.

Looking ahead

The evolving regulatory landscape poses challenges for both managers and owners of assets, requiring alignment and collaboration in order to establish a common understanding of sustainable investment concepts. However, to allow the market to thrive, there must also be sufficient flexibility to use various methods and pursue different goals framed by a common language for sustainable investing.

The full report as well as an Executive Summary in French and German are available on SSF’s website.