The pandemic has not only caused economic chaos around the world, but it has also had a deep impact on people’s lifestyles.

The pent-up demand to socialise, go to live events and travel is at an all-time high, with people eagerly waiting for the wide distribution of the COVID-19 vaccines. We have identified several leisure & entertainment sub-segments in which we see attractive opportunities that should appear as the world gets back to “normal” in the second half of 2021 and beyond.

Key takeaways

- The COVID-19 vaccines are game changers for the leisure & entertainment industry.

- There is significant pent-up demand for leisure & entertainment, and we have identified opportunities in the time-share, restaurant, casino and live-show sectors.

- For now, investors should be cautious about airlines and cruise operators until there are further signs of recovery in those industries.

Vaccines are game changers

COVID-19 has caused a crisis unlike any other we have experienced, not only because of the economic toll, but also due to the drastic lifestyle changes it has forced upon people. The pandemic has put an end to live entertainment events and severely restricted the ability to travel and socialise.

This has had a brutal impact on those businesses which depend on mass live interaction, such as air travel, cruises, hotels, casinos, live concerts and restaurants, with several companies having seen business brought to a standstill and have thus found themselves forced into emergency survival mode.

After the worst full-year GDP contraction since the Second World War (-3.3%), vaccines are paving the way for a strong recovery in 2021. Although it will take time for some industries to get back to pre-COVID-19 levels, the vaccines are game changers and enablers for the massive pent-up demand for leisure & entertainment.

Where can we find opportunities?

- Hotels & timeshares: in the hospitality sector we see the leisure segment recovering much faster than business, and within leisure we see domestic markets (short-term) as a safer bet than international ones (long-term). The timeshare business caters almost exclusively to leisure markets.

- Restaurants: fast-food restaurants were quick to pivot to online/delivery, but this came at a cost. As restaurants reopen, occupancy recovers and costs are cut, we expect profitability to increase significantly.

- Casinos: as tourism returns and occupancy restrictions are eased, we see Las Vegas tourism improving, with regional casinos also recovering.

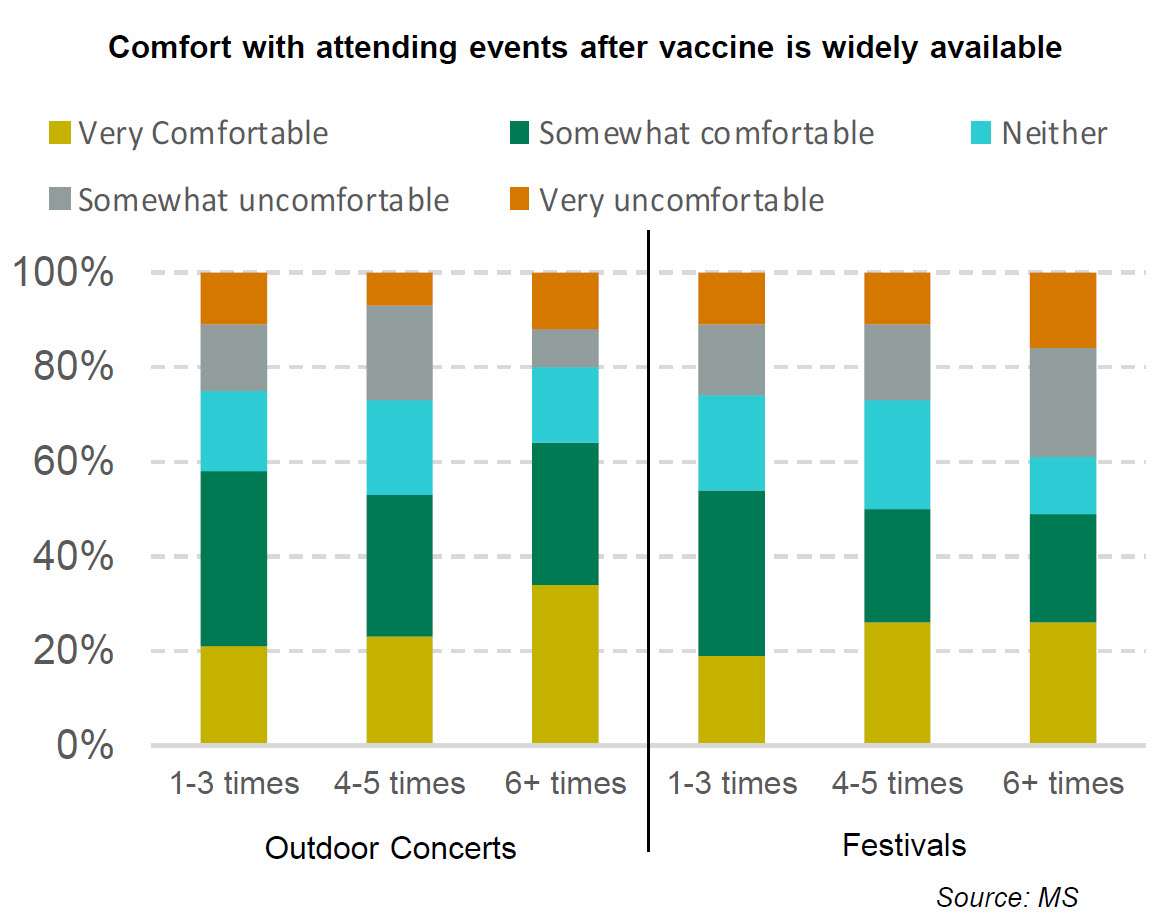

- Live shows: live concerts and festivals are synonymous with huge crowds, so any return to normality is still uncertain. Nonetheless, we see strong pent-up demand and a willingness to attend events during the summer.

What should investors be cautious about?

It is important not to be overenthusiastic and not to underestimate the impact that a year of inactivity and cash burn has had on some industries; not every sector will recover in the same way. Until the vaccines have been widely distributed and quarantine requirements are lifted, the following sectors remain too uncertain:

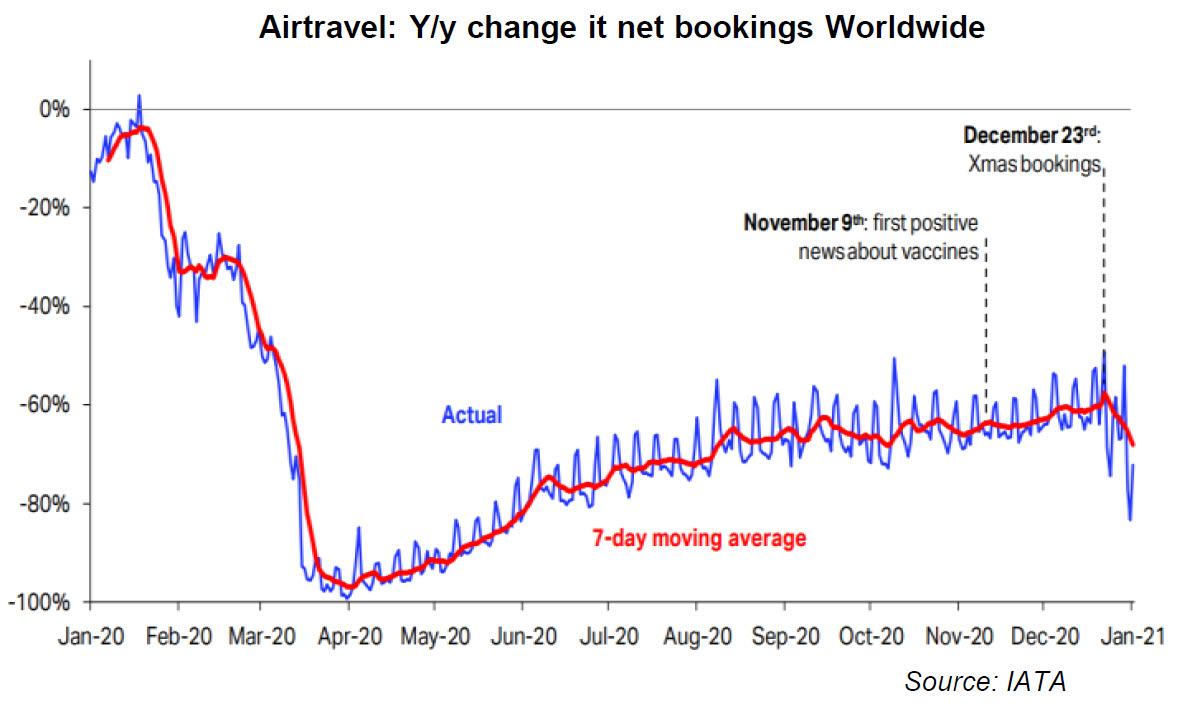

- Airlines: while air travel is expected to recover, led by domestic flights in the second half of the year, the profitable business segment will take much longer to recover as companies rein in expenses. For 2021, IATA expects airlines to lose around USD 40 billion (or USD 14/passenger), meaning they will continue to be heavily dependent on government assistance while balance sheets continue to deteriorate. A full recovery is only expected in 2024.

- Cruises: despite strong pent-up-demand and signs of high bookings for 2022, cruise operators have huge fixed costs and their balance sheets have suffered considerable damage over the past few quarters. When we look at current valuations, we do not see the spread picking up enough to compensate for the underlying risk.

Note: The products or services mentioned are provided as general information only and are not intended to provide investment or other advice. Not all products or services described are available in all jurisdictions. Past performance is not a guarantee of future results. For the full disclaimer, please refer to Legal Aspects.

Filipe Alves da Silva

Investment Advisor

Go to his Linkedin profile.

Nicolas Laroche

Global Head of Advisory Investment

Go to his Linkedin profile.