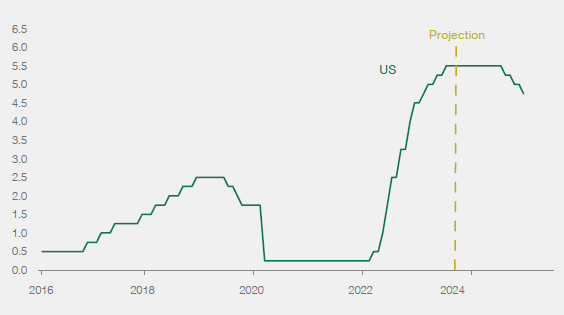

Yields on investment-grade bonds are at levels not seen since the GFC, propelled by an inflation wave that caught central banks off guard, forcing them to make the fastest set of rate-hikes since the 1980s.

With inflation moderating, the bar for further hikes is now significantly higher, indicating that we are undergoing a topping phase in rates.

Investment-grade bonds with intermediate maturities are, for the first time in a long time, offering attractive risk-reward with reasonable chances of achieving high single-digit returns with low volatility.

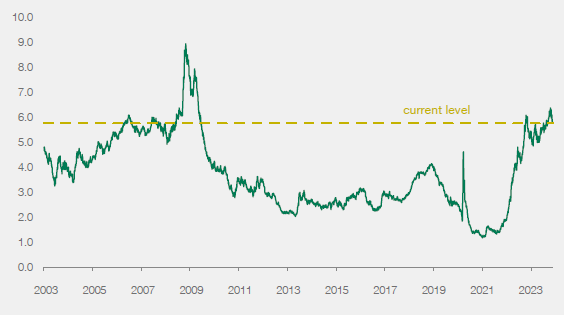

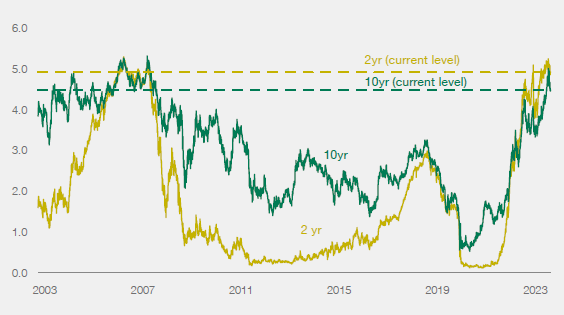

Government bond yields look toppish

Central banks have hiked rates repeatedly over the past two years in an effort to quell surging inflation, with the rest of the curve moving in sympathy to arrive at the top of a two-decade range (see chart).

UBP’s scenario is that inflation will take time to come back to the Fed’s 2% target, given sustained wage growth and resilient service prices, not to mention above-average oil price volatility driven by instability in the Middle East.

While communications from central banks still has a hawkish bias, the bar for raising rates further is now remarkably high, and we do not expect policy rates to move up from current levels, barring an unexpected pick-up in inflation. Conversely, rates should remain at elevated levels for the first half of 2024, with the first -rate cuts only coming in the second half of the year.

10-year Treasuries recently touched the 5% mark (the top of our 2023 range) but have since retreated to around 4.5%, which coincidentally is our end-of-year target for 2024. Nonetheless, we see a skew towards lower levels as the year progresses, as rates are already at elevated/toppish levels, not to mention the risk of a recession and/or declining inflation (all synonymous with lower rates).

The sweet spot: investment-grade, 3–5-year maturities

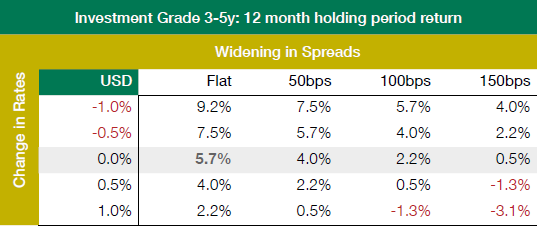

For the first time since the before the GFC, investment-grade bonds are offering attractive carry with the added benefit of potential capital gains as the yield curve normalises, putting a double-digit return within reach.

We find the 3–5-year maturity range to be the sweet spot, since it benefits from curve normalisation from its current inverted form (i.e. shorter-term rates being higher than longer rates). We expect shorter and intermediate rates to decline during the year, rather than longer rates to go up, as central banks normalise policy and cut rates in the second half of 2024. This range is also less vulnerable to the risk of higher rates than longer maturities, given the growing worries about US deficits and borrowing needs.

If one assumes the current 5.7% carry along with around 0.75–1.0% of rate normalisation (i.e. rates moving down by 0.75–1.0% on the 3–5-year range), then the expected return comes in at around 8.5–9.0%.

Conversely, if we are wrong and spreads widen and/or rates move up, the carry is enough to cushion the impact and still leave a 12-month holding period return in positive territory. Importantly, we would expect that, should spreads widen significantly, it would mean there is a recession, in which case a flight to safety is expected (i.e. lower rates).

Secure attractive yields

The time to secure higher yields is now. UBP recommends that investors take a significant overweight position in investment-grade bonds in the 3–5-year maturity range, fixing in the attractive yields offered by the asset class.

Although short-dated Treasury bills or deposit rates look attractive given the inverted yield curve, we caution against reinvestment risk – the risk of the yield investors can secure once their instrument reaches maturity (i.e. at which rate you can reinvest) being lower than the original yield. By extending maturities into intermediate bonds, investors are fixing the yield for a longer period.

Last, the argument can also be made that bonds are now more attractive than equities. UBP’s expectations for equity returns in 2024 is 10%, which is close to the circa 9% we expect for 3–5-year investment grade bonds; however, the volatility in equities is much greater than in bonds (16% vs. 3.5%, respectively), making investment-grade bonds a better risk-adjusted option.