Rencan Tian

CEO of UBP Investment Management (Shanghai) Limited, Chinese Equities

The content of our website is not intended for persons resident, or partnerships or corporations organised or incorporated inside the United States (“US Residents”). UBP does not market, solicit or promote its services inside the jurisdiction of the United States at any time. The content provided on the UBP website is intended to be used for general information purposes only. Therefore, nothing on this website is to be construed as an investment recommendation or an offer to buy or sell any security or investment product, nor as a guarantee or the future performance of any security or investment product.

To browse on UBP.com, please confirm that you are not a US resident.

UBP Investment Management (Shanghai) Limited was set up on 31 December 2014 as a joint venture between a group of experienced investment professionals and Union Bancaire Privée, UBP SA (“UBP”). With registered capital of RMB 30 million (USD 4.9 million), it is a company incorporated with limited liability in China, and was registered as a private investment fund manager with the Asset Management Association of China (AMAC) on 11 March 2015.

The UBP Investment Management (Shanghai) Limited office provides two main investment strategies:

1. Equity strategy

2. Quantitative strategy

An on-the-ground investment team in China

Proven risk management framework

Global investment presence

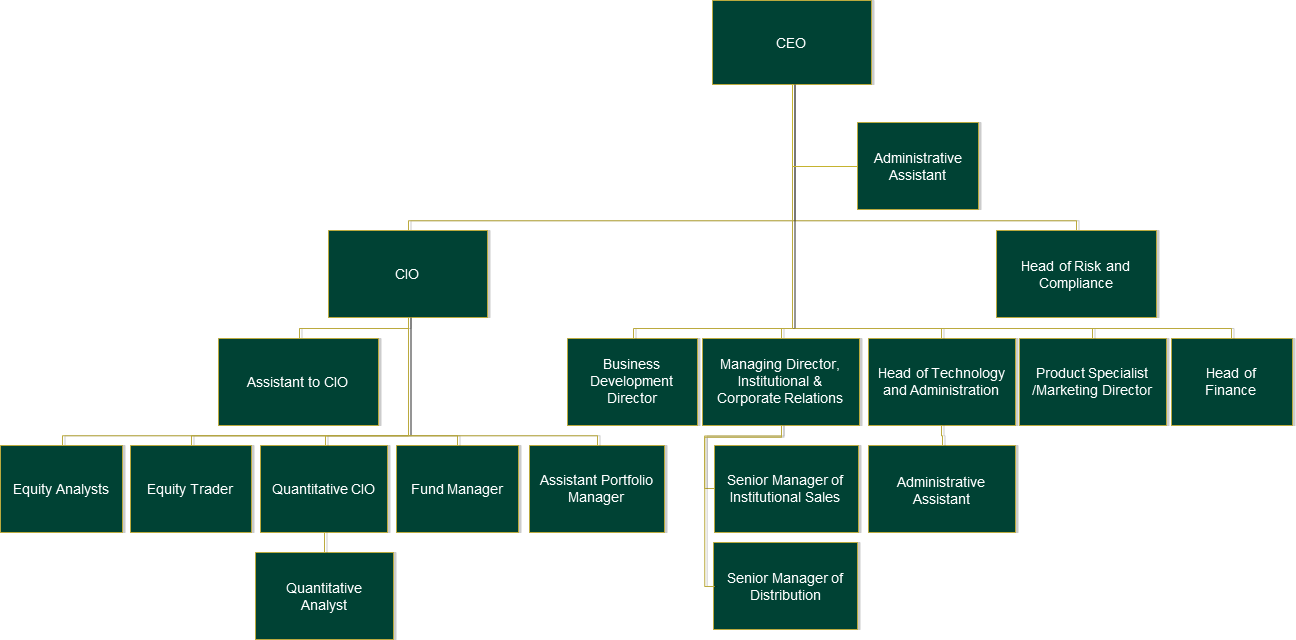

The investment management team

The investment management team brings together 21 experienced professionals, who cover investments, research, sales, marketing and compliance.

Rencan Tian

CEO of UBP Investment Management (Shanghai) Limited, Chinese Equities

UBP Investment Management (Shanghai) Limited

Room 1205, 12/F

Bank of East Asia Finance Tower

66 Hua Yuan Shi Qiao Road

Pudong

Shanghai

China

Tel: +8621 2062 9980 | www.ubpsh.com