All too often, economic progress and conservation of nature are seen as mutually exclusive. Indeed, biodiversity loss is considered to be the price to pay for development. In a new report, the Cambridge Institute for Sustainability Leadership (CISL), in cooperation with UBP, shows how the opposite is true by guiding financial institutions to measure their nature-related financial risks.

The economy depends on nature and has a role to play to preserve it. The preservation of nature is not merely in the interest of human welfare, but is essential for economic growth, too. This, in a nutshell, is the radical thesis formulated by the Cambridge Institute for Sustainability Leadership (CISL), an institution within the University of Cambridge that cultivates an active dialogue with pension funds, insurers and asset managers worldwide, and of which UBP has been a steering group member since 2018.

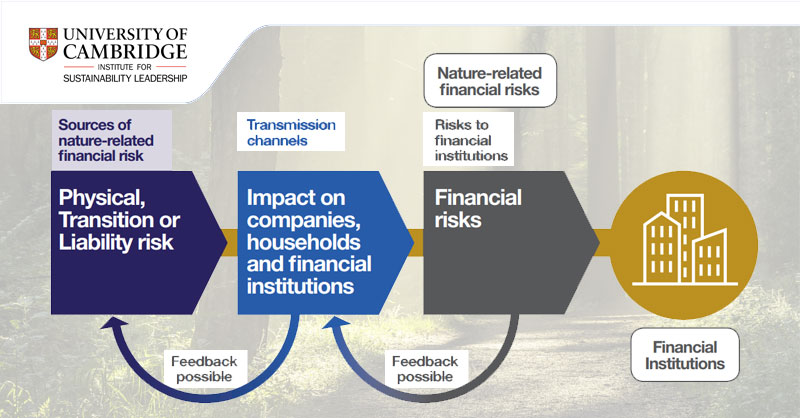

In other words, the degradation of our natural environment, known as ‘loss of nature’, poses a measurable financial risk, as the CISL’s “Handbook of Nature-related Financial Risks” shows. The reason lies in the services that nature provides to most economic activities. First and foremost, this concerns the agricultural sector, although the damage from environmental degradation goes far beyond that. The pollution of the air, water and soil is only the most visible aspect of a wider issue. The variety of life on earth, commonly referred to as biodiversity, is essential for human survival. For instance, insects and birds pollinate our crops, worms ensure the fertility of our fields, and forests are essential to purify the air, on top of preventing droughts, soil erosion and the spread of diseases.

Thinking a bit further, it becomes apparent how the bulk of our economy requires a healthy ecosystem in order to keep functioning. The value of the services that nature provides to the global economy is estimated to run in excess of USD 100 trillion. Yet, over a fifth of the world’s land is already degraded, while so-called “dead-zones” in the ocean extend for an area that exceeds the surface of the UK.

It follows that any damage to the fragile balance of the world’s ecosystems comes with an economic cost. In its latest handbook, the CISL has attempted to put a price tag on natural degradation, calculating that over half of global GDP is highly or moderately dependent on nature. Therefore, investment managers ought to take these costs into account in order to value their assets properly. According to the CISL, the financial exposure to the risk of loss of nature amounts to EUR 510 billion just for financial service providers in the Netherlands.

Victoria Leggett, Head of Impact Investing at Union Bancaire Privée (UBP), sums up the relevance of these findings:

“UBP is proud to support this guiding framework from CISL. Financial institutions are increasingly aware that the success of our economies depends entirely on the health and resilience of nature. Acting upon this awareness is not a departure from our core asset-management activity – it is a fundamental part of it. In identifying the most significant types of risk we face, the CISL’s Handbook for Nature-related Financial Risks represents an essential first step in the shift from awareness to action.”

The connection between the natural and the financial world from a risk perspective, which represents the basis for plotting financial risk exposure, is the key merit of the CISL’s handbook. The CISL’s members, UBP among them, are using these findings to develop methodologies measuring nature-related financial risks. As a long-term investment outlook and a tight grip on risk management are key aspects of its DNA, UBP welcomes the findings of this study and intends to educate its stakeholders on these matters.