SSF Market Study 2021 reveals what lies behind the growth in sustainable investments

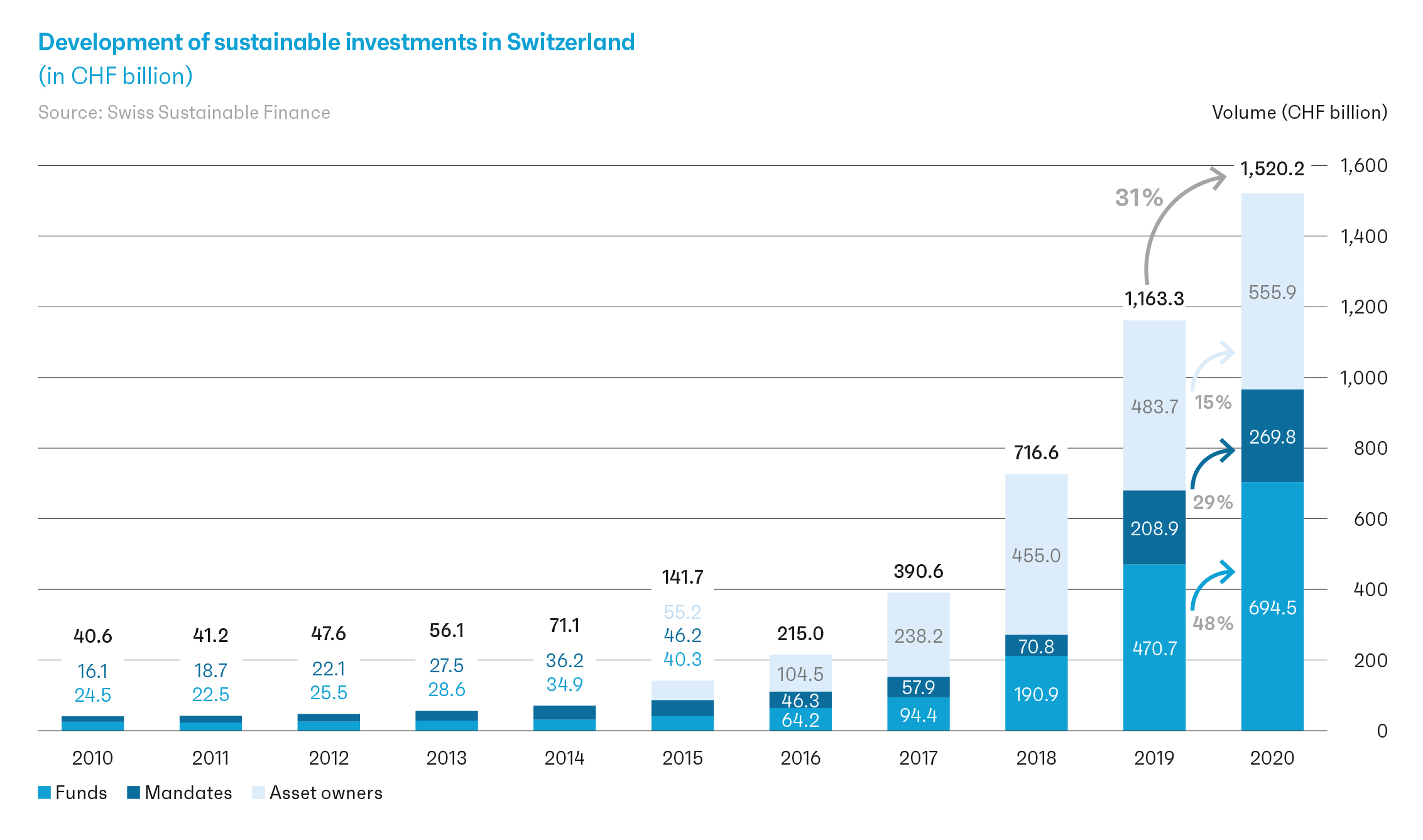

Sustainable investments once again experienced strong growth last year. According to Swiss Sustainable Finance’s Market Study 2021, which is released today, sustainable investments in Switzerland broke through the CHF 1.5 trillion barrier at the end of 2020, representing a 31% increase on the year before.

Source: Swiss Sustainable Finance’s Market Study 2021

The aim of this study is to give an in-depth insight into the dynamics of sustainable investments in Switzerland, pointing out any unfolding trends and identifying where challenges and opportunities may lie ahead for investors.

Two factors accounted for the lion’s share of the remarkable growth rate in sustainable investments in 2020: the increase in sustainable investment strategies for existing assets and the strong market performance of sustainably managed portfolios. Indeed, the latter on its own accounts for one third of the growth recorded in sustainable assets. Assets invested in sustainable investment funds rose by 48%, an increase that means they now represent over half of the overall Swiss fund market.

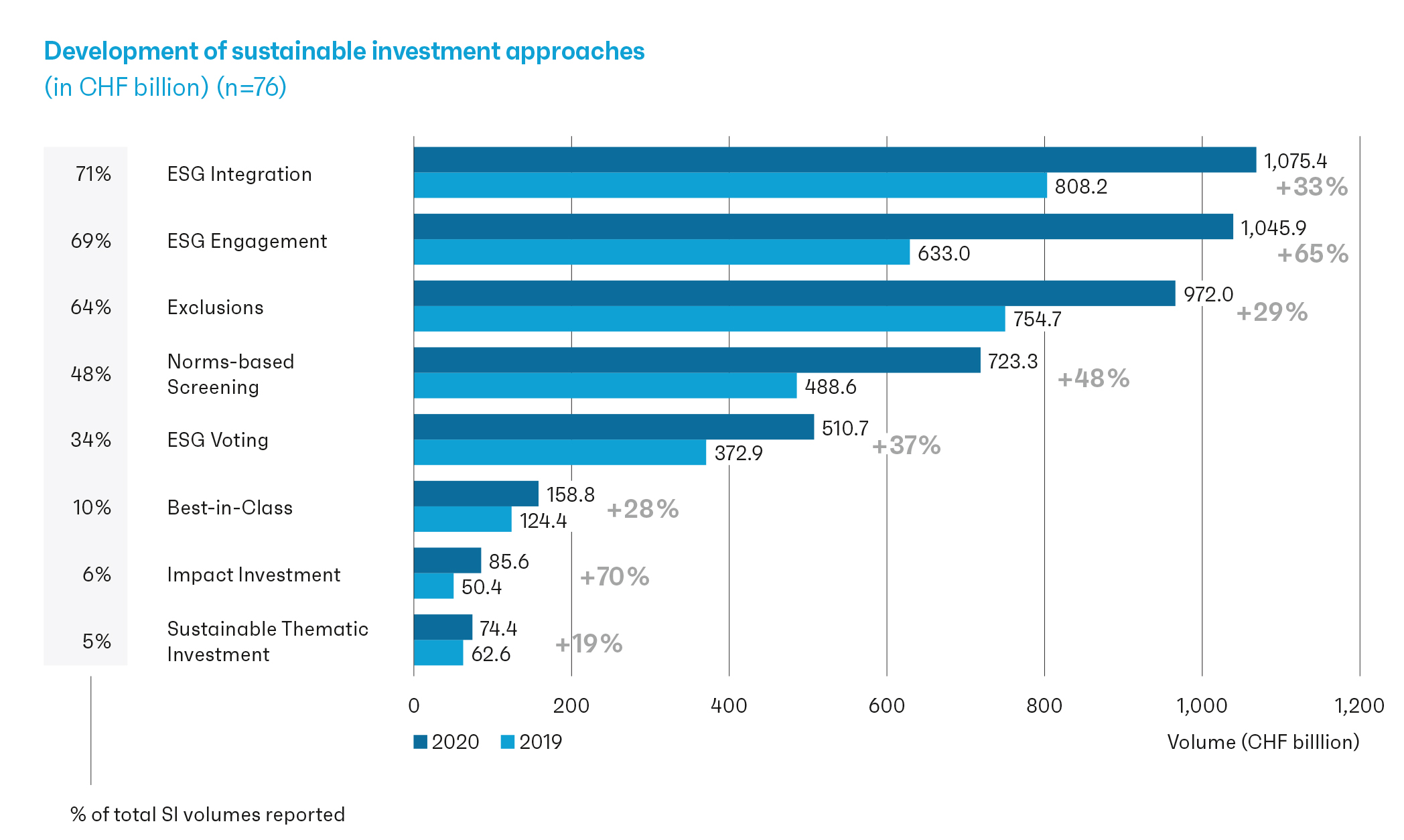

The study also reveals that, while individual sustainable investment strategies achieved even faster growth rates, impact investing is enjoying the highest growth rate, at 70%.

Source: Swiss Sustainable Finance’s Market Study 2021

Equally impressive is the rise in third-party certifications, such as sustainability certificates and labels, demonstrating a demand for transparent industry standards that define the criteria for sustainability within investment portfolios.

“For the third year running, UBP is a proud participant in this study. Our involvement as one of the main sponsors this year also reflects the Bank’s commitment to working with industry peers with the aim of expanding knowledge about sustainable investments.”

Jason Ulrich, Head of Responsible Investing, Investment Services

Swiss Sustainable Finance’s Market Study 2021 also includes an article by Victoria Leggett, our Head of Impact; it can be found on page 69 of the report.

The full study is available on SSF’s website here.