Pharma is a complex and fast-changing industry that plays a vital role in improving health outcomes and global access to medicines.

At a simplistic level the discovery and provision of medicines has a clearly positive impact on society and life expectancy and can dramatically improve quality of life.

Some communicable diseases have been completely eradicated and a golden age of drug discovery led by new technologies is transforming the lives of patients in many areas of high unmet need.

The global burden of disease is formidable; as populations age the prevalence of non-communicable disease rises. In addition, poverty, in both high- and low-income countries, exacerbates the demographic challenges. There has been a shocking increase in obesity and related conditions such as heart disease, diabetes and kidney disease over recent decades. The pressure added to stretched healthcare systems continues to rise and access to medicines in low- and middle-income countries remains a world away from the goal of universal care. Furthermore, the pandemic caused a terrible hiatus, setting back years of progress.

Assessing the positive impact of individual companies

We see two primary, distinct areas where companies can achieve a positive impact: firstly, in the development of new medicines that improve patient outcomes – here the concept of the QALY helps us; secondly, in their contribution to improving access to medicines, particularly in low- to middle-income countries where coverage gaps remain extreme.

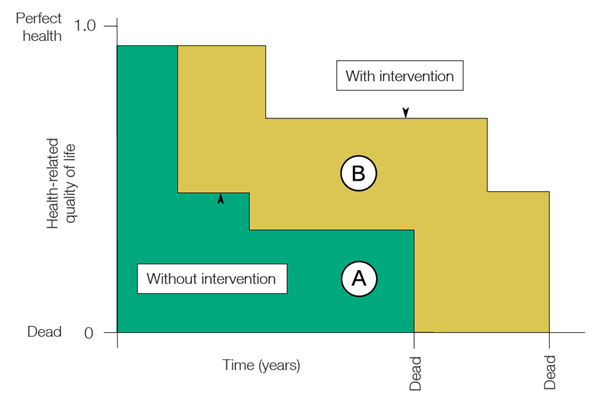

Introducing the QALY – One Quality-Adjusted Life Year is equivalent to one year of perfect health. The QALY concept is used to assess the value of new treatments and medicines. It is used by the National Institute for Health and Care Excellence (NICE) in the UK to help guide the drug approval process.

The measure evaluates life expectancy using data including trials. Quality of life is assessed by asking a selection of patients to rank their life quality on a scale of 1 to 10. For example, if a new drug is deemed to increase life expectancy by 5 years compared to the current standard of care but patients say that their health in those years ranks at 5 out of 10, then the treatment has added 2.5 QALYs. In the simplified graphic below the added QALYs are represented by area B – logically the quality of life experienced deteriorates over time both with and without the treatment (area A).

Healthcare providers can then compare the uplift in QALY to the cost of the new treatment in assessing its value. As investors we can think about the medicines of the companies we analyse in this way, as a guide for asking the right questions.

An example of strong QALY uplift is Sanofi’s lead drug called Dupixent, the first effective medicine for atopic dermatitis (eczema), which can be severe. Here the high additional QALY greatly improves the value of the drug given the vastly improved quality of life it affords compared to the much less effective standard of care which was steroid-based.

Source: Wikipedia

Access to medicines - While impacts are complex and difficult to measure, pharma companies are very good at disclosing details of the projects that they engage in and many have clear targets. For example, in 2014 AstraZeneca launched its ‘Healthy Heart Africa’ programme with the ambition of reaching 10 million people with elevated blood pressure, and hence cardiovascular disease risk, by 2025.

The programme is designed to be sustainable, so it includes the provision of over 1,200 facilities and the training of over 10,000 healthcare workers. While disclosure of these projects from the industry is thorough, the challenge for the investor is to judge the effectiveness of these efforts and to compare companies to see who the leaders and laggards are. Thankfully help is at hand here from an organisation called the Access to Medicines Foundation (AMF). The AMF was founded in 2003 with the aim of addressing the inequality of access to medicine by pushing the pharmaceuticals industry to do more for the billions of people lacking access. It produces an assessment of the top 20 global companies (representing around half of the global medicines industry by value) ranking them on their policies and achievements. This index reveals a wide gulf in the level of impact being achieved, highlights areas for improvement for all of the companies, and gives investors the tools to engage effectively with them. One source of frustration for us is that the financial costs of these industry access programmes are not disclosed as they tend to be funded at a divisional level by each company. We have raised this issue during our engagements with companies and are optimistic that, in time, greater financial transparency will allow us to make even more informed comparisons and decisions.

Footprints – negative industry impacts

In terms of emissions the industry has a relatively low footprint but still has an important role to play in some respects. The biodiversity issues are far more complex, not least because plants and natural products have been used extensively as both active and inactive ingredients in medicines.

We have been impressed with the leadership shown by AstraZeneca with their extensive and detailed carbon-reduction plan, which has been costed at around USD 1 billion to achieve a zero-carbon ambition by 2045. This includes a USD 400-million investment to eliminate F-gases from inhaler propellants, an initiative that will help them achieve their interim target of a 95% reduction in scope 1 and 2 emissions by 2026.

In recent company engagements we have focussed on the complex biodiversity impacts of the sector. Current drug development methods focus on areas such as biologics and cell and gene therapy. Sanofi recently indicated that none of their current R&D pipeline is either based on or derived from plants. However, many older drugs and inactive ingredients rely on plant, animal or other natural ingredients, and companies also have issues with controlling the leakage of active pharmaceutical ingredients in the supply chain. These are important and sensitive areas to continue to delve into and understand.