Robert de Guigné

Group Head of Sustainability

The content of our website is not intended for persons resident, or partnerships or corporations organised or incorporated inside the United States (“US Residents”). UBP does not market, solicit or promote its services inside the jurisdiction of the United States at any time. The content provided on the UBP website is intended to be used for general information purposes only. Therefore, nothing on this website is to be construed as an investment recommendation or an offer to buy or sell any security or investment product, nor as a guarantee or the future performance of any security or investment product.

To browse on UBP.com, please confirm that you are not a US resident.

瑞联的理念

瑞联银行深信,要最好地服务我们的客户、员工和社会,在作出投资意见、决策和日常运营时,有必要更全面地考量环境和社会因素。

不仅对于我们的投资也对银行本身,只有顾及环境、社会和治理(ESG)准则,我们才能实现瑞联创行的长远愿景,协助客户妥善装备应对未来金融市场的情势。

瑞联的方式

瑞联从两个维度来融合可持续发展的信念,包括我们的投资和营运,然后在此中识别了对瑞联长远成功实践举足轻重的五大策略性主题。

五大策略性主题

瑞联落实可持续发展的信念,从完善治理架构开始,自上而下监督各策略有效施行,并适时作出理据充分的决定。

瑞联执行委员会和董事会每季度讨论可持续发展的最新进度报告,从顶层督导整个集团的实践。

此委员会由在各主要业务和支援部门之中,与实践可持续发展策略相关的成员组成,负责督导可持续发展项目的执行情况。

此委员会监察在投资程序中实践可持续发展的进程,专责制定负责任投资原则和政策,以及监察ESG的发展。

此委员会负责就瑞联运营界定、实践和监督可持续发展策略的施行,例如环境影响衡量、员工事务和社区参与等。

瑞联认为,负责任地投资与财务表现息息相关。为了履行为客户及其后代守护和增长财富的职责,我们必须全方位考量影响投资组合韧力和强健性的所有因素。此外,我们也深信,金融业在全球应对社会和环境挑战的大业中责无旁贷,瑞联有责任引导资金为可持续发展转型提供融资,以对转型新经济形态作出贡献。

同时,随着可持续金融的法规不断演变,亦驱动瑞联推陈出新,确保我们负责任地经营业务和符合新规。

与推动负责任投资的努力相辅相成,瑞联承诺以负责任的方式管理我们作为企业所带来的影响,这包括衡量环境足迹、人力管理和工作环境,以及我们在社区的参与和赞助活动。

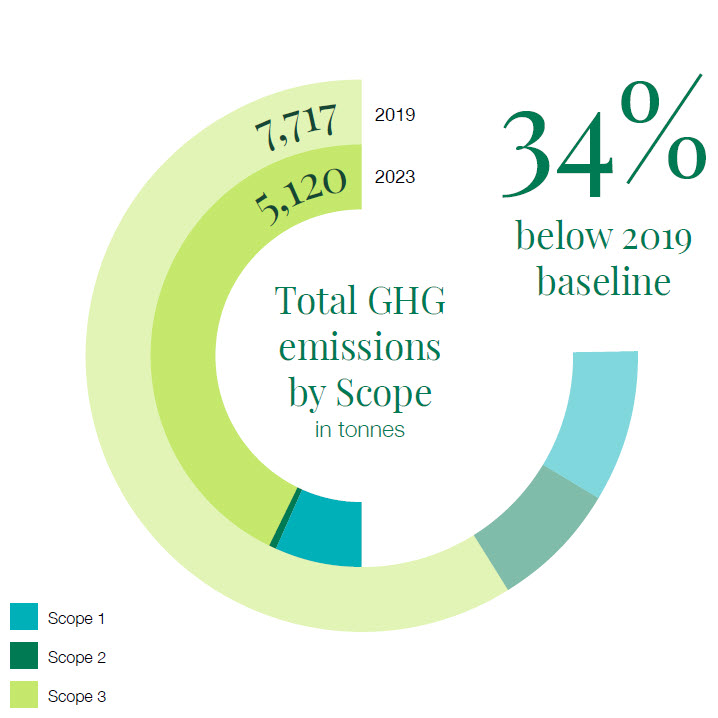

减低运营的温室气体排放是瑞联管理环境影响的优先工作。我们继续推进迈向2025年的减排目标,旨在将碳足迹较2019年的基线水平减少25%,这目标涵盖由我们运营而产生的范围1、2和3的温室气体排放。

瑞联通过以下方式减低碳足迹以实现减排目标

转用可再生能源和提升办公大楼的节能效益,是瑞联减排策略的核心。此外,我们在办公大楼全面转用LED照明、在非办公时间将计算机进入休眠模式,同时关闭其他电器和冷暖气系统,以及翻新在日内瓦的主要办公楼和在租约期满后将部分办公室迁到较节能的大楼。

我们对非客户相关的出行和飞行旅程实行更严格的审批程序,并且采取额外措施以提升员工的相关意识,推动负责任的商务旅行。

我们鼓励员工采用可持续的通勤系统,并让员工选择每周居家办公一天。

2023年瑞联关键绩效指标

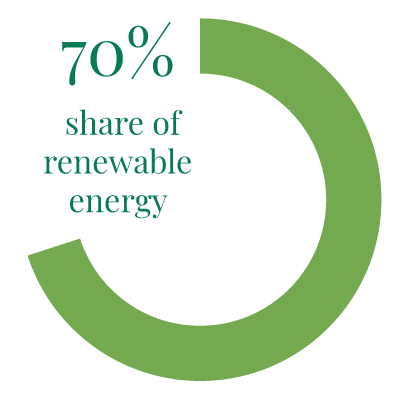

可再生能源发电占比*

*(包括在没法获得可再生能源供应的地点,购买可再生能源证书(REC))

70% share of renewable electricity

温室气体排放总量(按范围以公吨计)

低于 年的基线水平

自2020年以来,我们继续在集团层面补偿余下的碳排放,旨在持续削减碳足迹。

劳动力多样性是引领瑞联与时俱进的动力,吸引和保留人才对瑞联持续成功不可或缺,我们因此力求提供理想的工作环境和丰富的专业深造机会。

进修和培训

我们在内部推出一系列线上学习计划,另有人才和领袖培训计划,同时支持员工参加外部深造课程,特别着重提升对可持续发展的认识,以及与我们产品和服务相关的可持续发展培训。

培育下世代

瑞联对培育年青一代向来不遗余力,为新生代提供学徒和实习生计划。自2021年起,我们再加推毕业生计划,让年青有为的大学毕业生在瑞联开展事业。了解更多:瑞联培育后进的计划

多样性、公平和包容

瑞联推崇能者居之的制度,致力创造包容多样性和公平的工作环境,让员工肯定自我价值、受到尊重和启发潜能。

瑞联重视支持和参与在办公室所在地的社区,长久以来赞助多项文化、教育、研究和社会项目。

我们也鼓励同仁参与由集团和不同地区慈善组织和非政府组织合办的社区活动,这包括植树、清洁日、物资捐赠和教育项目等。

协力推动变革

建立可持续金融系统需要不同利益关系者众志成城,瑞联已与多个志同道合者组成强大的合作伙伴,同时作出一系列策略性承诺,以及成为多个全球和地方倡议、协会和机构的签署机构或成员:

我认为推动可持续发展在于寻找经营、发展和创新方式,以创造一个大自然能够繁衍和后世能够繁荣的健康环境。在瑞联来说,这表示采取务实、耐心和专业的态度,预早洞察风险和机会,并说服我们的所有利益关系者实践可持续发展的重要性。