- In the eurozone, momentum remains positive and the growth scenario has been regularly revised up. 2.1% is expected for 2018.

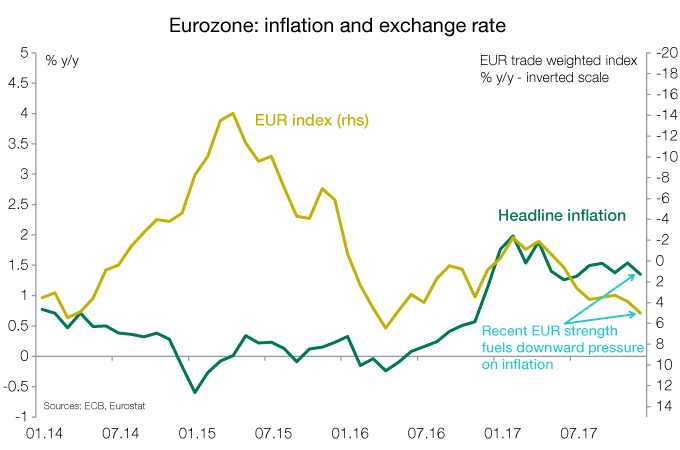

- Inflation is still below target (1.3% y/y vs 2%), recent EUR strengthening has postponed any rebound in inflation.

- The ECB has already reduced its government bond and credit purchases from EUR 60 bn to EUR 30 bn; these amounts should stay unchanged until September 2018.

- Several ECB governors have recently changed their minds and adopted a less dovish view on QE and interest rate management.

- Despite inflation remaining low, the ECB should shift to less dovish communication in Q2 as strong growth continues.

- The ECB is increasingly likely to end its QE next September.

- A first rate hike, expected around Q2-2019, will be the first step in its exit strategy.

What is the ECB’s strategy?

Focus on the ECB’s monetary policy: still accommodative, but for how long?