Secular trends’ relevance is increasing

Secular trends held up well relative to the broader equity market during the recent market downturn. In the context of easing lockdowns in most major countries, this investment theme can still offer attractive value in terms of forward-valuation metrics, above-average visibility, and decent balance-sheet quality. As a result, we believe it is well positioned to navigate the current and future market environment.

The COVID-10 pandemic might even act as a catalyst and accelerate the development and adoption of secular trends.

Consumption patterns

The economy’s sudden halt and social distancing measures have had an impact on the way people and businesses operate and consume globally. Companies are reacting and adapting quickly to the new environment in order to continue serving their customers while preserving their employees’ health and safety. The pandemic is clearly contributing to the reinforcement of existing tailwinds in online trade, contactless/mobile payments, remote working and education solutions, as well as cloud services.

It now seems very likely that the current situation will have a long-lasting, positive effect on the investment themes mentioned above, enabling them to accelerate through the adoption curve. Store closures have obviously pushed consumers to shop online, but the trend was already gaining traction. Reluctant consumers might subsequently realise that, at least for bulky or heavy items, online shopping is more convenient, leading to permanent changes in consumption patterns across generations.

Disruptive innovation

Similar to most major crises, the unprecedented situation the world is facing calls for accelerated innovation. Companies are rethinking their business models and day-to-day operations; social distancing poses challenges for the vast majority of collective, in-person activities.

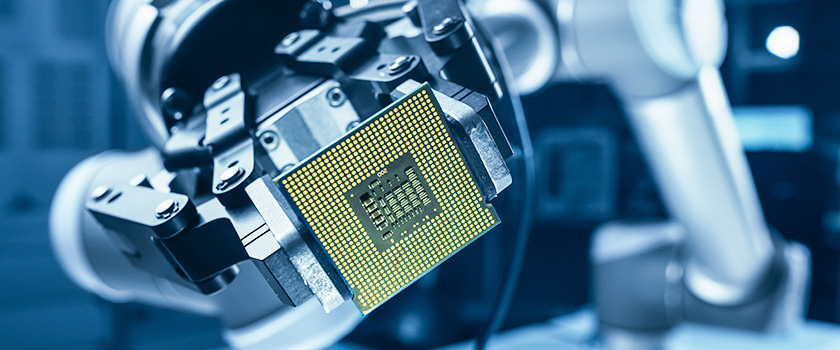

Robotics is of particular interest in this context, especially if social distancing persists and makes it impossible to perform jobs in those sectors that require close personal interaction, such as food services, the hotel business, social assistance and cleaning. Manufacturers of robots have been quick to react. Fully-automated disinfection robots which use ultraviolet light, are already roaming hospitals, nursing homes and other public spaces around the globe.

The pandemic is contributing to accelerating the process of robot acceptance. AI and robotics will penetrate additional professional spheres, potentially significantly reducing the social skills advantage that humans have over AI. Every recession leads to structural changes in labour markets, and automation as a whole could emerge as one of the beneficiaries of our new lifestyles.

Demographics

Healthcare innovation, the ageing population and its associated healthcare cost burden are key components to watch out for. The current pandemic, stricter hygiene rules and consequent behavioural shifts have raised health awareness among populations and governments. The “new normal” is likely to act as a catalyst, leading to increased investment and the early adoption of innovative solutions in the healthcare space.

Online consultations are a good example. These existed before the outbreak but demand for them is now surging, accelerating the change towards more cost-effective solutions and leaving the door open for more automated procedures.

Climate change

Although not directly related to the outbreak, themes such as resource efficiency, environmental protection, evolving mobility, solar and wind power are likely to be supported by future fiscal stimulus packages around the world.

Historically, infrastructure spending has formed part of stimulus packages and governments will attempt to kill two birds with one stone this time around, simultaneously stimulating the economy and improving sustainability.

Cédric Le Berre

Senior Analyst