Stockmarkets have had a good run for a number of years, supported by accommodative central banks, in which any dip has provided a buying opportunity. However, a new market environment has developed in the last few months. Firstly, the situation has changed in terms of volatility, which has risen from the historically low levels it reached in 2017. There has also been a shift in central-bank monetary policies, pushing up interest rates. This could undermine the complementary nature of bonds relative to equities within a portfolio and their role as a safety cushion in a falling market. As a result, many investors may now have a lower risk appetite and, although they want to remain exposed to equity markets, they are also looking for ways to mitigate risks and protect themselves in the event of a market downturn.

It is possible to offer investors a low-cost, active and dynamic asset management solution that aims to increase hedging of their equity exposure if markets fall. The solution involves a strategy that uses listed, liquid derivatives, and offers the possibility of adjusting a portfolio’s equity exposure without having to buy or sell stocks. As a result, it avoids brokerage fees and any tax impact that would arise from such dealings. From a technical point of view, the strategy is a combination of several complementary asset management methods, using futures and options. It adapts to various types of market movement, such as a steady decline or a crash. As a result, the strategy does not depend on getting the timing right. It has other attractive aspects, such as exposure to equity volatility, which tends to rise in times of market stress.

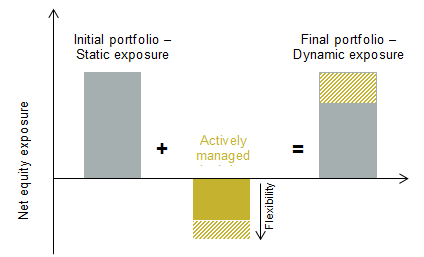

An asset management solution based on actively managed short positions is suitable for any kind of investor, because it helps manage risk. It can also be adjusted to the desired level of hedging. Figure 1 shows how adding dynamic short positions reduces a portfolio’s equity exposure, which was initially 100%. The reduction in the portfolio’s net exposure reduces its risk, and the flexibility of the protection provided means that an equity portfolio’s net exposure can be adjusted over time.

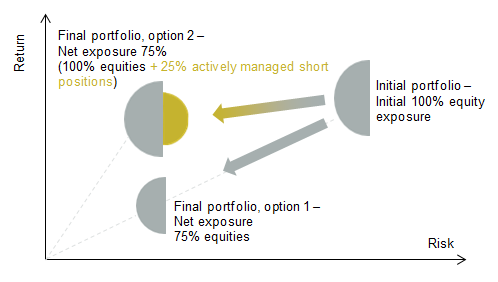

This strategy also aims to make the portfolio’s return profile more asymmetric. Its opportunity cost in a rising market should, in the medium term, be more than offset by its positive contribution in a falling market. Figure 2 looks at both risk mitigation and returns. Starting with the same initial portfolio, reducing risk through the addition of an asset management solution based on short positions (option 2) will aim to improve the risk/return profile compared with simply reducing equity exposure (option 1), for the same final exposure (in this example 75%).

Figure 1: Actively managed short positions allow dynamic adjustment of an equity portfolio’s net exposure

Figure 2: Actively managed short positions improve an equity portfolio’s risk/return profile

Philippe Henry

Global Head of Cross Asset Solutions

Geoffroy Gridel

Senior Portfolio Manager