The COVID-19 outbreak has accelerated the digital transformation of the enormous US healthcare market, which is projected to swell in value to USD 5.7 trillion by 2026. The main driver of technology adoption within the sector remains its ability to reduce costs and improve patient outcomes.

Key messages

- The pandemic has accelerated the digital transformation of the enormous US healthcare market which is projected to swell in value to USD 5.7 trillion by 2026.

- The IT sector is responding to healthcare issues, providing savings and improving patient outcomes.

- The healthcare IT sector will grow massively over the next decade and now is the time to enter this promising investment space.

Source: Bloomberg Finance LP

At the crossroads of two innovative industries

Healthcare information technology (HCIT) is at the crossroads of two innovative industries: healthcare & IT. HCIT includes any type of technology used to exchange health-related information across computerised systems between patients, physicians, hospitals, governments, providers, insurers and other stakeholders.

Fact 1: The US healthcare sector is costly and inefficient

The US healthcare sector is cost-inefficient as three factors come into play:

- Prescriber (physician)/provider (hospital): decides treatment but does not consume or pay

- Consumer (patient): consumes but does not decide/pay

- Payer (insurer): pays but does not decide or consume

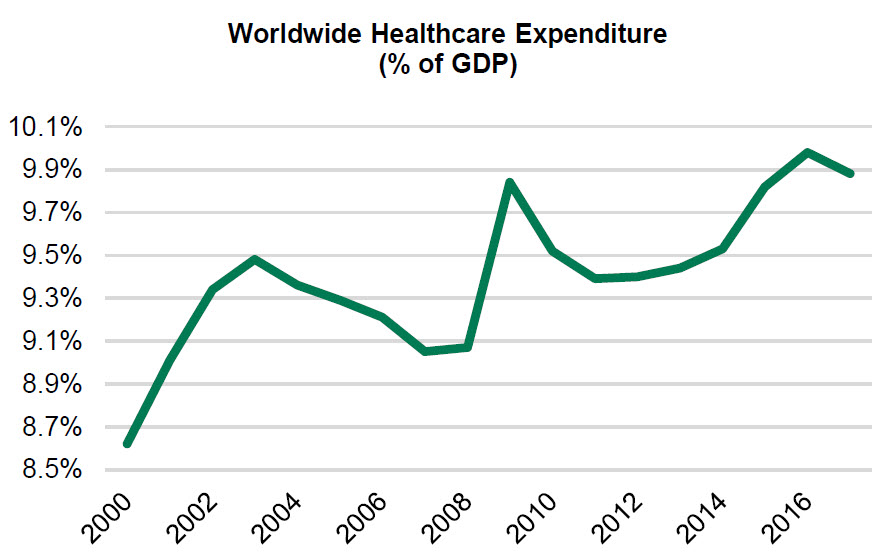

US healthcare spending is the highest ratio in the world at nearly 20% of GDP (~USD 3.5 trillion), compared with just 10% in the EU. However, this does not translate into better life expectancy, with close to 50% of Americans living with a chronic condition. We estimate that a third of healthcare spending in the US is wasteful (close to USD 1 trillion). The most significant driving force behind HCIT adoption is decreasing costs and/or optimising current healthcare spending as the global population ages, new diseases appear, and emerging market demand increases further.

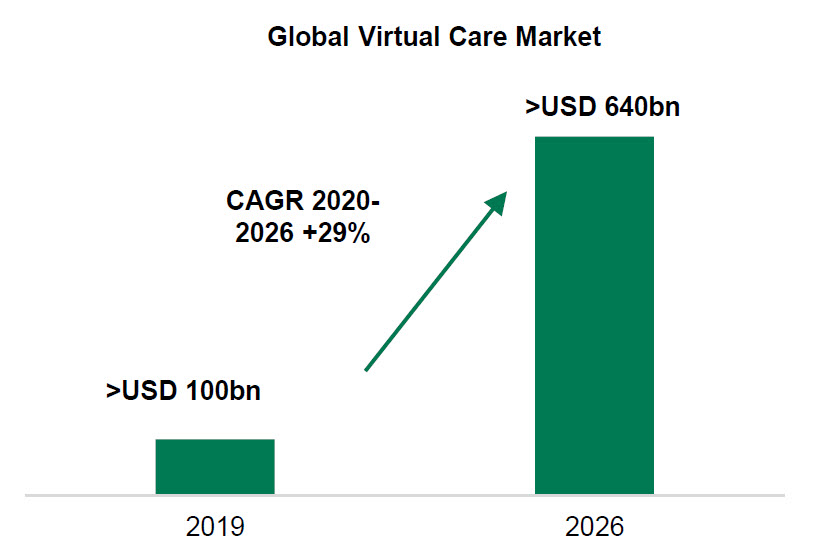

Source: Global Market Insight / CAGR estimates

Fact 2: The IT sector is responding to healthcare pain points

- More convenience: the use of telemedicine is more convenient for patients. In the US, you can get an appointment to see a general practitioner in 10 minutes, compared with an in-person average of ~25 days.

- More efficiency: technology, bioinformatics and algorithms allow a human genome to be sequenced in just few hours at a low cost.

- Better patient outcomes: tracking blood sugar and insulin levels in real-time through a connected device prevents complications for diabetic patients (hypo/hyperglycaemia).

- Less expensive healthcare solutions: thanks to more efficient solutions and better patient outcomes (such as fewer hospitalisations), technology allows for healthcare savings.

Four promising blocks where HCIT is playing a major role

HCIT is not a sector by itself and there are many different business models. HCIT companies are often less well-known and/or privately held, and require thorough bottom-up research. Technology is now present across the healthcare sector’s entire value chain. We have identified four blocks which offer attractive characteristics, such as disruptive innovation, strong growth prospects, and a large and underpenetrated market:

- Virtual care/telemedicine: regulatory hurdles have been removed thanks to the pandemic, which has caused a +300/400% surge in telemedicine use.

- Informed consumer: out-of-pocket payments by patients are on the rise. There is demand for more transparency and cost efficiency (consumerisation of healthcare).

- Connected devices: new technologies allow new, accurate and more convenient medical devices, making real-time home care/monitoring possible.

- Research, diagnosis and monitoring: powerful tools and tests are now available thanks to breakthroughs and technological innovations.

Note: The products or services mentioned are provided as general information only and are not intended to provide investment or other advice. Not all products or services described are available in all jurisdictions. Past performance is not a guarantee of future results. For the full disclaimer, please refer to Legal Aspects.

Pierre Corby

Healthcare Equity Analyst

Go to his Linkedin profile.

Nicolas Laroche

Global Head of Advisory Investment

Go to his Linkedin profile.