The RMB had a different experience in the last twelve months to what we expected, initially falling but then recovering to about 6.66 per dollar. This is where it was in September in 2016. Despite not depreciating as we had expected, the RMB performance was still not good for investors. If a US investor had, for example, bought a basket of Emerging market government bonds benchmarked to the JP Morgan local currency government bond index, they would have generated 4% dollar returns. This compares to slightly negative returns (-1%) from holding Chinese RMB 5y maturity government bonds over the same period.

We anticipate a volatile coming twelve months for the RMB and again think that investors can generate higher returns from a basket of Emerging market government bonds rather than Chinese local currency government bonds. We do not own Chinese local currency government bonds in our portfolios although we do keep a watch for a buying opportunity if, following the 19th National congress, there is a further aggressive tightening of monetary policy in China or if IPOs in China accelerate. Both have an ability to pull in money to support the RMB.

The pressures on the RMB have not disappeared

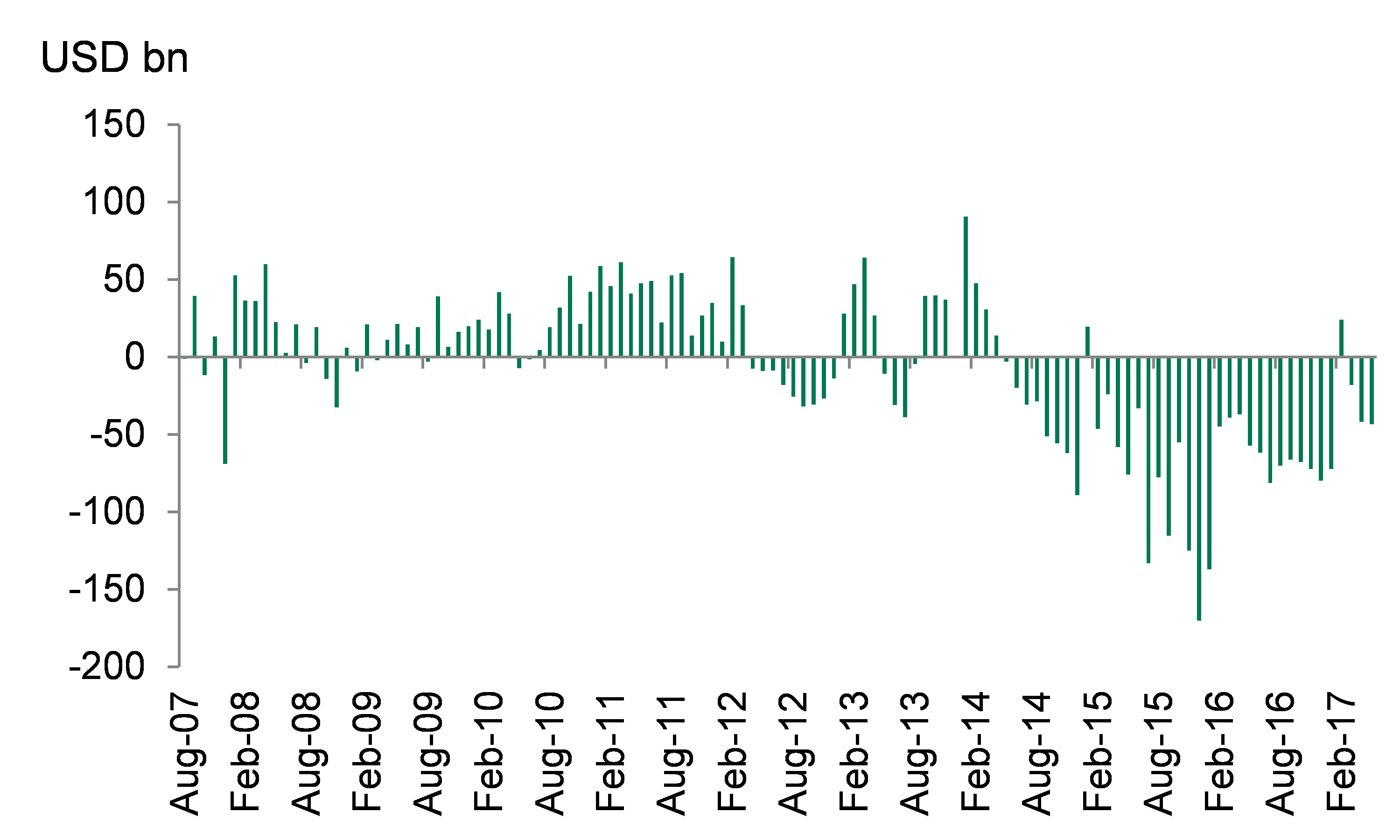

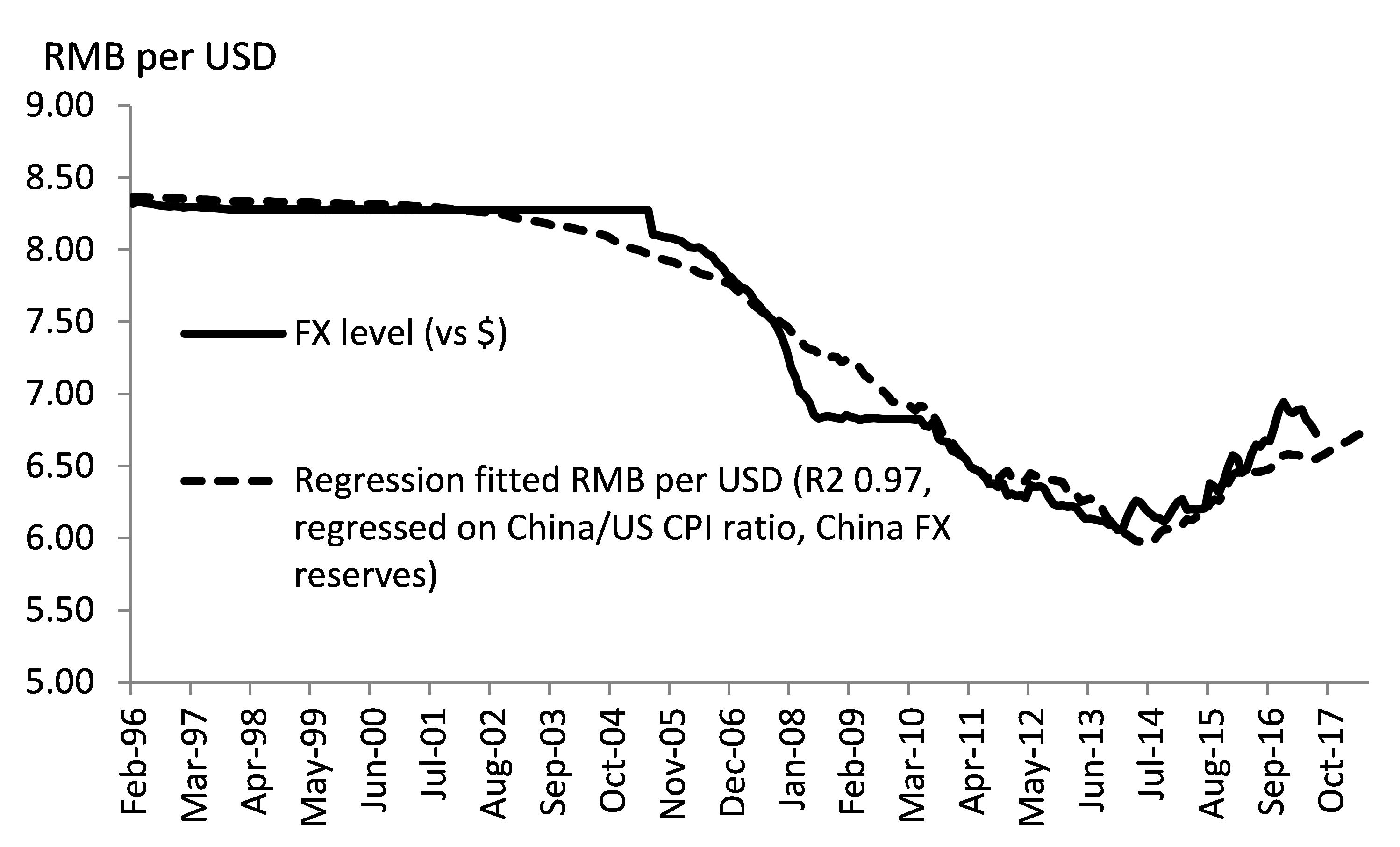

Capital outflows from China are lower than in 2016 but they are still present and likely driven by the portfolio diversification of domestic retail investors, repayment flows for maturing external debt and foreign direct investment by Chinese companies. These outflows are unlikely to disappear because there is a good long term reason for them: Chinese domestic investors will need many years to diversify their savings and Chinese companies are finding more and more investment opportunities abroad. These opportunities are because of China’s increasing trade and investment links with other countries, helped in part by the government’s ‘one belt one road’ initiative. In 2016, capital outflows from China were USD816bn/7% of GDP and this year, they have shrunk to around USD 152bn/annualized 3% GDP (Figure 1 shows Bloomberg estimates). This lessening outflow is due to tighter official controls but regardless the outflows will likely continue to push FX reserves and the RMB downwards. Figure 2 shows a regression of RMB (per dollar) against relative inflation between China and US, and the level of FX reserves in China. Somewhat surprisingly these two variables alone explain a large part of the long term RMB trend (R2 of 0.97 in the regression). If we assume a small drop in Chinese FX reserves and Chinese CPI growth at around 2.4% (against 2.0% in the US for the next 12 months), the regression suggests RMB of around 6.75 in 12 months’ time i.e. a little bit weaker from current levels.

Figure 1. Estimated capital outflows from China

Source: Bloomberg (25-Aug-17)

Figure 2. Model for RMB per USD

Source: UBP (25-Aug-17)

The economic challenges are high

High corporate debt levels in China (156% of GDP at the end of 2016) are a bigger challenge for Chinese policymakers than managing capital outflows. How this debt challenge is addressed will have RMB implications. Corporate debt levels rose quickly (from 100% of GDP at the end of 2008), are now high and will be a challenge to service as the Chinese economy matures and GDP growth naturally slows. The next twelve months, in keeping with the gradualist stance of Chinese policy makers, likely sees moderate policy steps to deal with this challenge. However if there is something more aggressive steps, it could change how investors look at the RMB and create new investment opportunities in China. If there is any change in policy to deal with this challenge it might only happens after the National congress (due around September – October this year).

How one meets the debt challenge will have implications for the RMB

One possible option for meeting the debt challenge is a more aggressive stance towards shifting large businesses in China towards an equity raising model and away from debt financing of investment. More aggressive IPOs would fit in this strategy especially if there is a lot of positive preparatory work e.g. mergers, strengthening governance practices, strengthening the balance sheets of the companies to be listed etc etc. If IPO’s are only aimed at raising money from investors, the aggregate value of the IPO might not get much traction with investors especially given the past performance of the shares of newly listed companies (according to Bloomberg analysis, see figure 3). A successful permanent ramp up in the number and size of IPO could in turn attract non-resident investment flows to China, keep resident money inside the country and boost the RMB.

Figure 3. Post IPO performance

Source: Bloomberg (25-Aug-17)

A more plausible, option is additional monetary policy tightening balanced by looser central government fiscal policy. Money market rates in China and bond yields (government and corporate) have been steadily rising in the past twelve months as the result of policy steps. It would make sense in our view to extend this tightening: to contain the housing market (both the demand for housing and the demand for land), to prevent Chinese corporates from leverage up any more in RMB, and to attract domestic investors into vanilla fixed income products and away from leveraged/riskier fixed income products. Tighter monetary policy need not mean a sharp economic slowdown if the central government budget is loosened and Chinese exports continue to do well. Of course higher interest rates could put already highly leveraged corporates under some pressure but the ones that are of critical importance to the government could receive public support. Tighter monetary policy could help narrow the gap between average Emerging market local currency bond yields (currently around 6.0%) and China (3.6% on 5yr bonds), helping attract inflows to support the RMB.

Careful with local market assets for now

We repeat our warning that we made a year ago, namely that there is some potential for being long the RMB on more possible aggressive policy steps in the months ahead. But until that point, the RMB does not offer enough yield or the prospect of appreciation, to entice us away from local currency government bonds of other Emerging markets.

Koon Chow

Emerging Markets Macro and FX strategist